Fees

Over time costs increase, inflation marches on and the rebates from Medicare and health insurers do not keep up.

An anaesthetic is billed in units - the number of units your anaesthetic comes to is primarily determined by the complexity of your operation, your medical co-morbidities and the length of the operation. The number of units is then multiplied by a dollar value per unit to arrive at the final cost of your anaesthetic.

As a guide, Medicare will rebate you ~$20 per unit

Your insurer will rebate you between ~$10-19 per unit, in addition to the Medicare rebate (*see below for HBF)

The fee which the AMA recommends anaesthetists charge, which the ASA also recognises as a fair price, is ~$106 per unit (2024). This figure is indexed annually to the Consumer Price Index (CPI) and average weekly earnings (AWE).

This means there is a shortfall of approximately $70 per unit between what Medicare and health insurers rebate and what anaesthetists are recommended to charge.

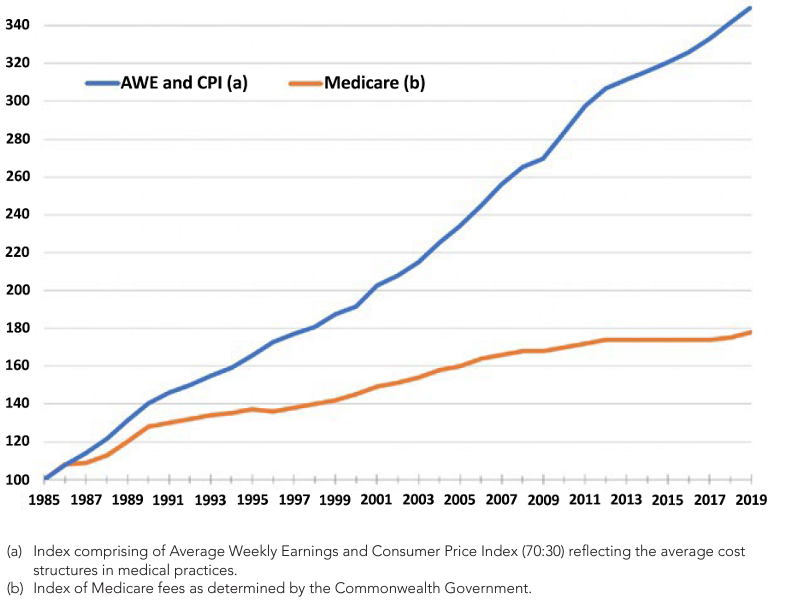

Unfortunately over the last 35 years, the annual indexation in the Medicare Schedule Fee has consistently been less than inflation (see chart). The Medicare rebate was also frozen between 2013-2020. Health fund insurers have also not proportionately raised their contributions over time.

This means that there may be a shortfall or out of pocket expense to your anaesthetic fee which you will be asked to contribute.

You will be advised of any gap and the approximate amount prior to the procedure. If you are not advised of this or you are unsure or have more questions, please contact Dr Maghami’s rooms before your procedure. This estimation may not be possible in emergencies.

For more information regarding fees for anaesthesia, click here

*Most health insurers will still contribute this ~$10-19 per unit even if you have to pay an out of pocket expense. Unfortunately HBF does not - this means that if your specialist charges a gap/out of pocket expense, HBF will reimburse you less towards the cost of your anaesthetic. This means you will likely have to pay a larger out of pocket expense than persons with other private health insurers do. Please discuss this with HBF if you have any queries.